Filing bankruptcy has changed quite dramatically in the last 5-10 years and if you're considering it, then knowing the basics will determine if you want to go down this road or not. My goal with this blog is to share the basics and compare bankruptcy to the option of debt settlement so you can make the best & most informed decision. The first & most important issue the reader must realize is that there are two types of bankruptcy that are the most common - chapter 7 and chapter 13.

Bankruptcy versus Debt Settlement

Chapter 7 Bankruptcy

This type of bankruptcy allows the filer to erase most or all of their debt. There are certain qualifications that must be met and the most important one is how much money you make. If you make over the median income of the state in which you live, then filing chapter 7 is not even an option. In other words, if your income is average or above average, you cannot file chapter 7. The next issue with which to be concerned is if you are a home owner - home owners with a good amount of equity in their home are also not allowed to file chapter 7. The amount of equity that disqualifies you from filing depends on the state you live. Simply Google the median income in your state and also the amount of home equity you are allowed and this will give you a much clearer direction as to your options. Chapter 7 also stays on your public record for 10 years so it may prohibit you from getting a vast number of jobs or even prevent you from renting at certain places. It typically will prevent you from buying a home or obtaining a car loan for many years and attending financial counseling classes are required.

Chapter 13 Bankruptcy

This type of bankruptcy - also called "wage earner's plan" - is typically used for homeowners and it will stop any & all foreclosures from advancing on your home and allow you to stay in it. A plan is filed with the court that will outline the precise way your income will be spent & distributed to your creditors. The mortgage will often be paid in full each month and then a percentage distribution is placed on the remaining amount of money left over which is paid to your creditors. This plan usually last for 5 years and can be a bit humiliating since the court will tell you how, when, and where your income is to be spent. Financial counseling classes are also a mandatory part of this procedure.

Debt Settlement - A Viable Option

If the main debt a consumer has is unsecured debt (credit cards, unsecured personal loans, medical bills, store & gas cards, car repossessions) and they are able to handle all of their other financial responsibilities, then debt settlement is definitely a viable & realistic option. Debt settlement is when all of your unsecured debt is resolved for less than what you currently owe. If you live in the state of Texas, there is a company - Integrity Debt Solutions - that specializes in helping Texas residents and implements various state laws that are very helpful & beneficial to reducing your debt. The time to complete the program is anywhere from 12-48 months depending on your income & savings potential. The main benefit is that you could have your debt resolved for around 50% of what you owe AND it will take half the amount of time compared to paying off your debt.

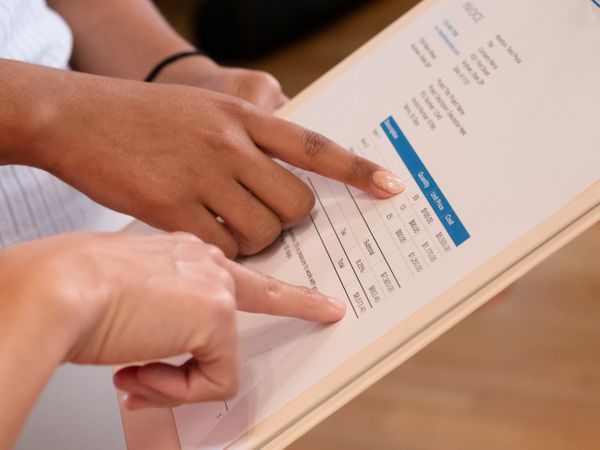

Compare The Costs

What is the cost of entering debt settlement? Let's take a look so you can compare. If you enter 8 credit card accounts totaling $30,000 into a debt settlement program, you can stop your minimum monthly payments and begin to save money each month in order to resolve or negotiate a lower amount on each credit card account. A good conservative estimate is to take 50% of your debt or $15,000. Then say you are able to save $400 per month. After one year, you will have $4,800 ($400 x 12 months) and the company can begin to negotiate settlements for you potentially resolving 2-3 of your accounts. In year two, suppose you continue to save $400 per month and the company is able to resolve more of your debt and another 2-3 accounts. In year three, you now have 2 accounts left to resolve and if you continue to save $400 per month, by the end of the third year, the company most likely would be able to resolve these last two accounts. Now you are totally out of credit card debt and you paid around $15,000 to do so.

Important Details to Consider

If you would like more information regarding debt settlement, simply give us a call at 1-833-431-3631 or 1-877-296-1199 and we will will answer your questions and email you some great materials which will educate you further. You can also call a local bankruptcy attorney in your city/area and they will most likely give you a free consultation so you can learn more and see if you can qualify for bankruptcy. If you cannot even qualify, then obtaining as much knowledge about the debt settlement option would clearly be in your best interest. FYI - Integrity Debt Solutions is the only company that specializes in serving Texas residents and we are the lowest cost provider. We have been operating since 2004 and we also offer a money-back guarantee that no one else in the industry offers. Our A+ rating with the BBB speaks for itself and we are proud to be a Christian-owned & operated business. We will tell you the truth!